David L. and Elsie M. Dodd Professor of Finance

Columbia Business School

About

I am the David L. and Elsie M. Dodd Professor of Finance at Columbia Business School and co-director of the Private Equity Program. I study financial intermediation via private equity and the financing of high-growth startups. My research aims to understand if and how financial intermediaries in private equity add value, and when they do, what that teaches us about financing and operational frictions faced by companies.

I am also a Research Associate at the National Bureau of Economic Research (NBER), an associate editor at the Review of Financial Studies, Journal of Financial Economics, Journal of Corporate Finance, and Management Science. I edited the JCF Special Issue on Private Equity and acted as co-editor of the Journal of Economics & Management Strategy through 2024.

Recent Research

March 2023

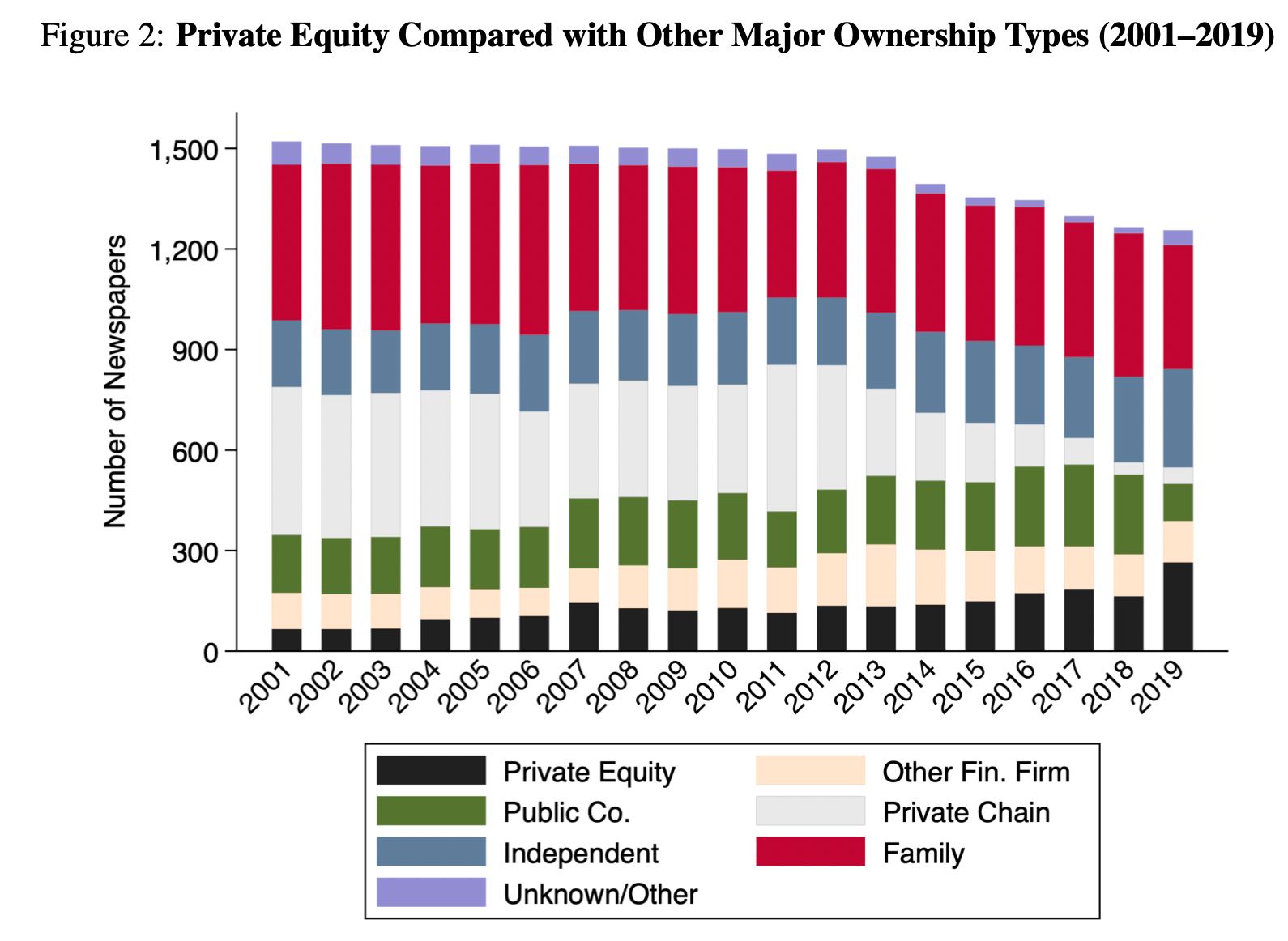

Local Journalism under Private Equity Ownership

With:

Arpit Gupta and Sabrina Howell (NYU Stern)

Local daily newspapers have historically played an important role in U.S. democracy by providing citizens with information about local policy issues. However, in recent decades local newspapers have struggled to compete with new online platforms for readers’ attention. Private equity investors—who specialize in reorganizing struggling firms in distressed sectors—have entered the industry. How do these new owners affect newspaper content, survival, and local civic engagement? We document nuanced effects, contrasting with the polarized debate on this topic in the media and political discourse. On one hand, we find that private equity ownership leads to higher digital circulation and lower chances of newspaper exit. On the other hand, we document a change in news composition away from information about local governance, and lower employment of reporters and editors. Finally, we find declines in participation in local elections, consistent with local newspaper content being relevant for civic engagement. The results have implications for knowledge about local policy issues and highlight trade-offs surrounding media ownership.

February 2022, Annual Review of Financial Economics

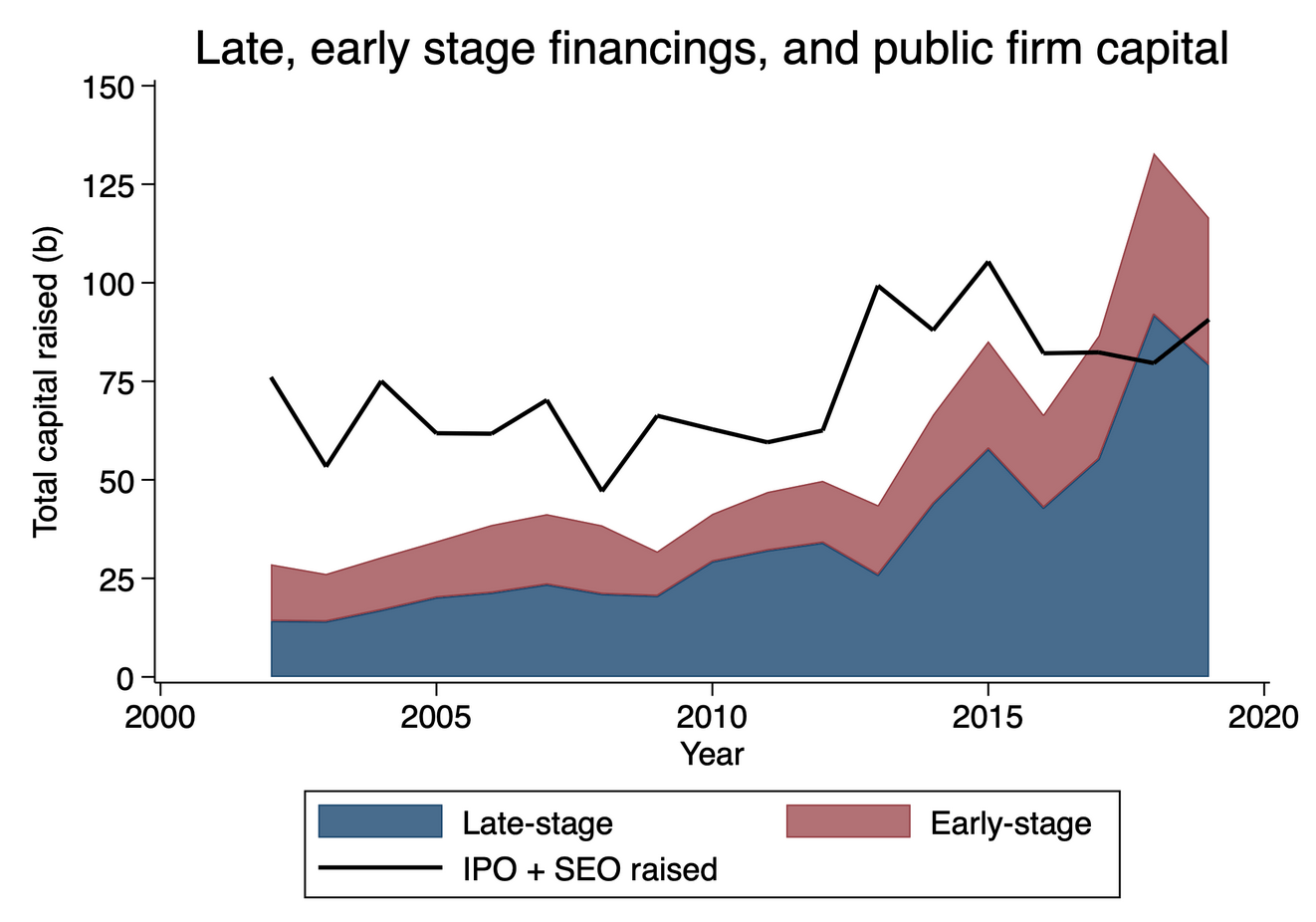

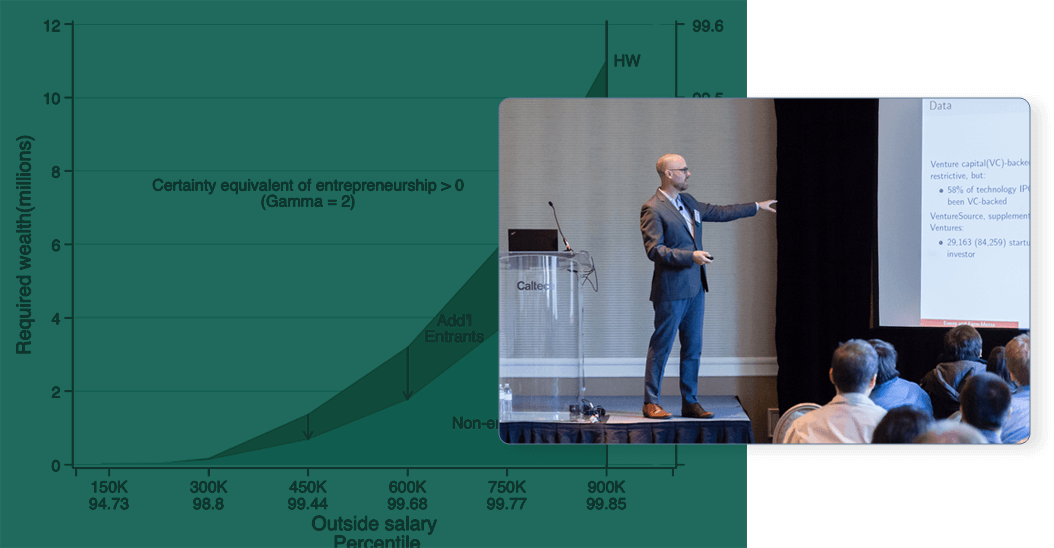

Private or public equity? The evolving entrepreneurial finance landscape

With: Joan Farre-Mensa (Univ. of IL at Chicago)

The U.S. entrepreneurial finance market has changed dramatically over the last two decades. Entrepreneurs raising their first round of venture capital retain 30% more equity in their firm and are more likely to control their board of directors. Late-stage startups are raising larger amounts of capital in the private markets from a growing pool of traditional and new investors. These private market changes have coincided with a sharp decline in the number of firms going public—and when firms do go public, they are older and have raised more private capital. To understand these facts, we provide a systematic description of the differences between private and public firms. Next, we review several regulatory, technological, and competitive changes affecting both startups and investors that help explain how the trade-offs between going public and staying private have changed. We conclude by listing several open research questions.

August 2024, Cond. Accepted, Journal of Finance

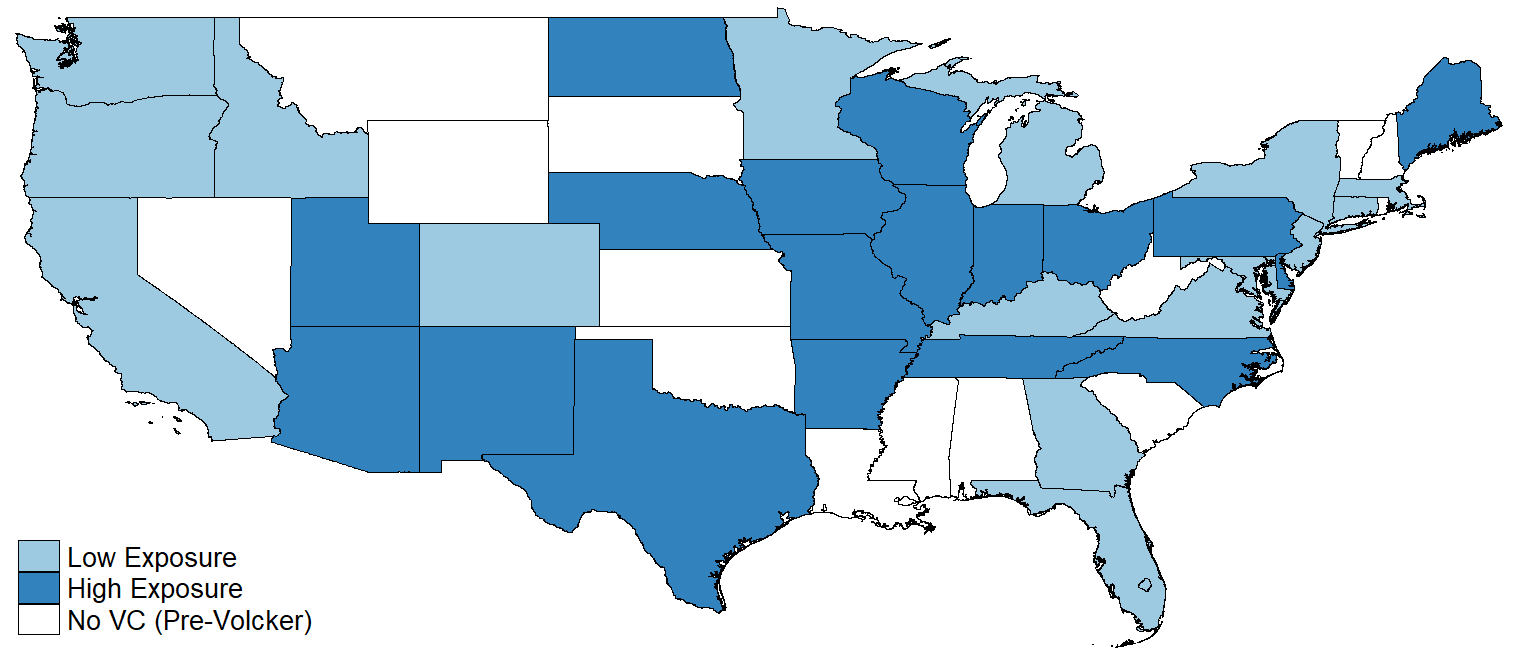

Venture Capital and Startup Agglomeration

With: Jun Chen (Univ. of IL, Chicago)

The paper studies venture capital’s role in the geographic clustering of high-growth startups. We exploit a rule change that disproportionately impacted U.S. regions that historically lacked VC financing via a restriction of banks to invest in the asset class. A one-standard-deviation increase in VCs’ exposure to the rule led to an 18% decline in fund size and a 10% decrease in the likelihood of raising a follow-on fund. Startups were not wholly cushioned: financing and valuations declined. Startups also moved out of impacted states after the rule change, likely exacerbating existing geographic disparity in entrepreneurship.

2024, Journal of Financial Economics

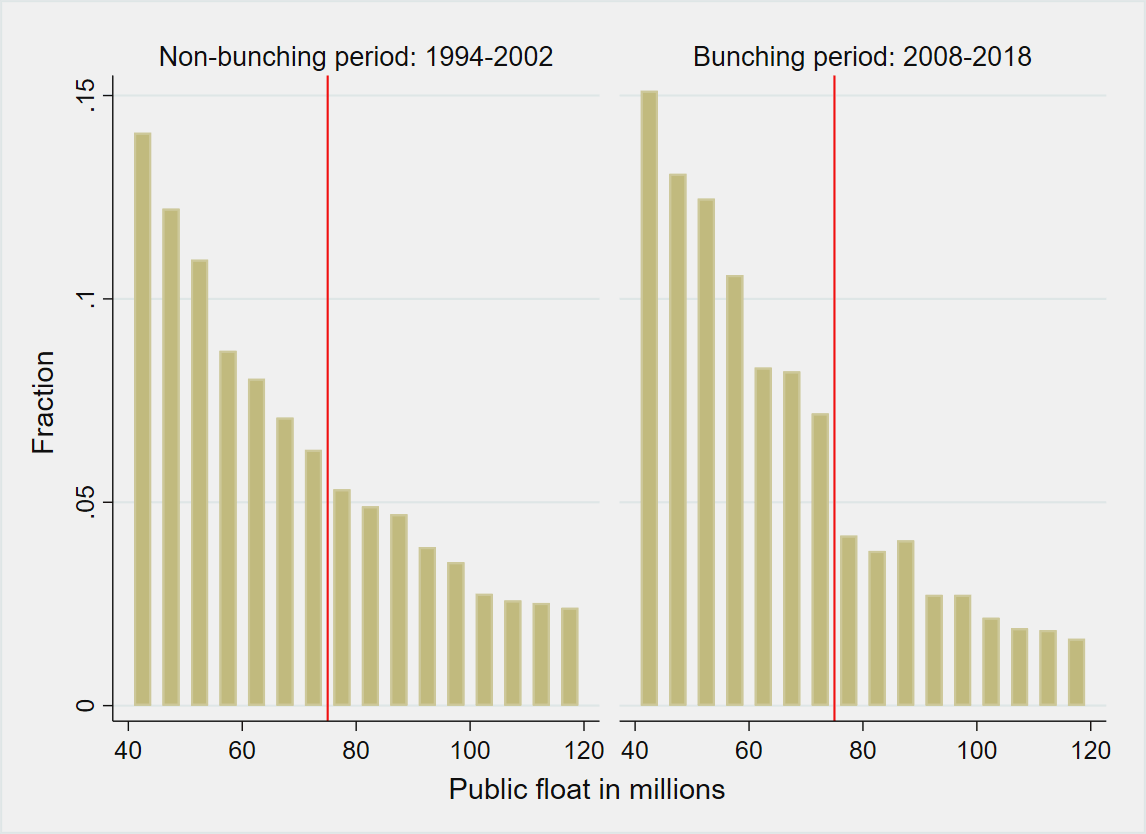

Regulatory Costs of Being Public: Evidence from Bunching Estimation

With:

Kairong Xiao (Columbia) and Ting Xu (Univ. of VA)

Working Paper

We quantify the costs of major disclosure and governance regulations by exploiting a regulatory quirk: many rules trigger when a firm’s public float exceeds a threshold. Consistent with firms avoiding costly regulation, we document significant bunching around three major regulatory thresholds. Estimations reveal that three examined rules’ compliance costs range from 1.2% to 1.8% of market capitalization for firms near thresholds. Depending on the extrapolation assumptions, total costs for a median US public firm vary from 2.1% to 6.3% of market capitalization (with 4.3% being our preferred estimate). Regulatory costs have a greater impact on private firms’ IPO decisions than on public firms’ going-private decisions, but such costs only explain a small part of the decline in the number of public firms.

Ongoing Projects

Not all my projects are papers. Here is a list of conferences and workshops that I co-organize, code and data associated with my papers and some longer-term initiatives. Contact me if you want to learn more or get involved.

Workshop on Entrepreneurial Finance (WEFI)

A virtual workshop, seminar and lecture series featuring research in entrepreneurial finance and innovation.

WEFI site

Columbia Private Equity Conference

An annual conference bringing together leading academics studying private equity, venture capital and entrepreneurial finance.

Conference website

Data and Code

Repositories of both data and code from many of my research projects are available here.

Github page

Private or Public Equity?

Website companion to “Private or Public Equity? The Evolving Entrepreneurial Finance Landscape” (joint with Joan Farre-Mensa). Paper website