Research

Working Papers

OCT 2025, Working paper

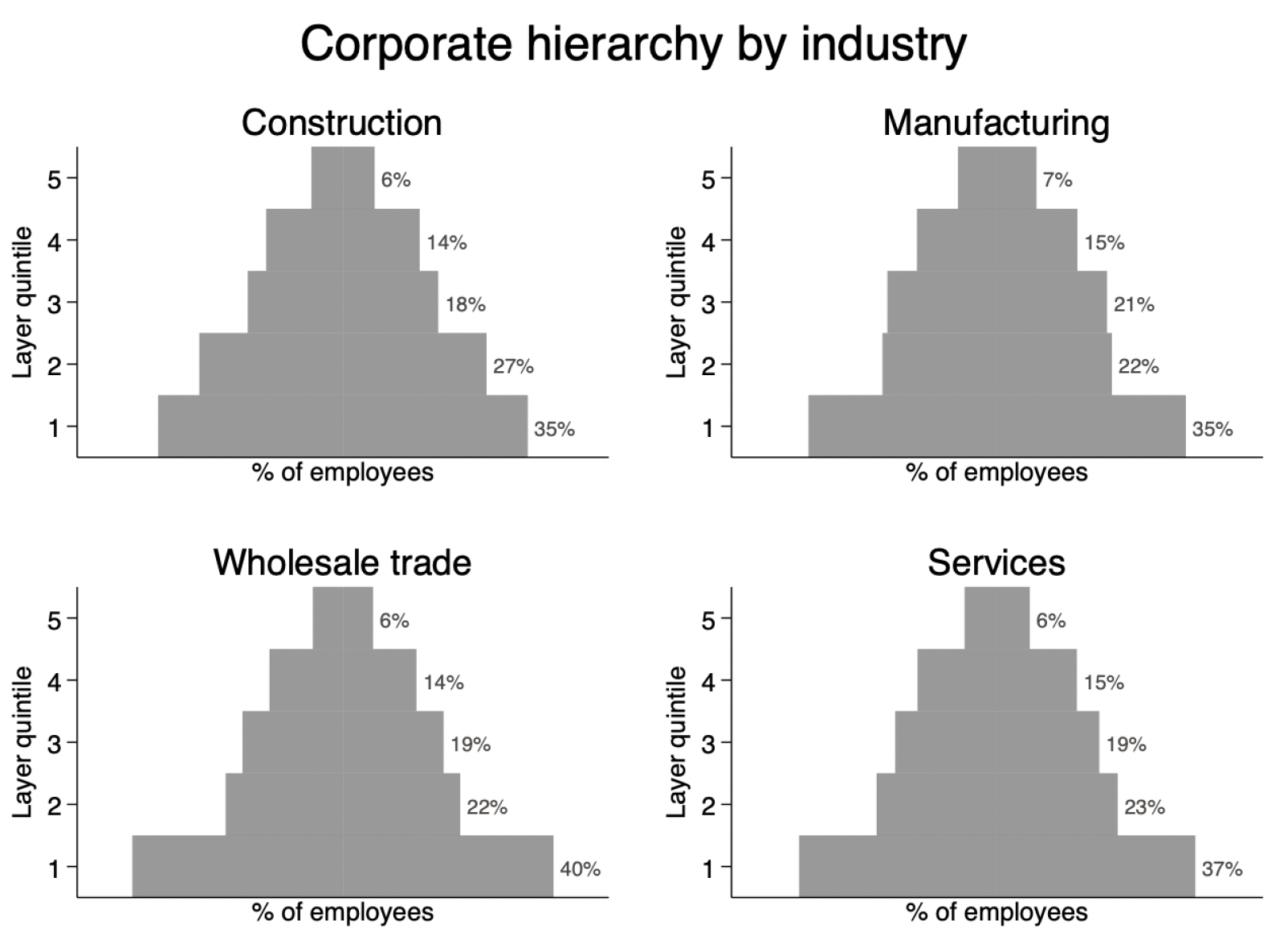

Corporate Hierarchy

With: Xavier Giroud

We measure corporate hierarchy using the online resumes of 7 million employees from over 3,100 U.S. firms.

Firms with more layers have a more educated workforce, higher internal promotion rates, and longer employee tenure.

More hierarchical firms exhibit higher profitability but also face greater administrative costs.

Firms adapt their structure to external shocks, adding layers for demand spikes and flattening with AI adoption

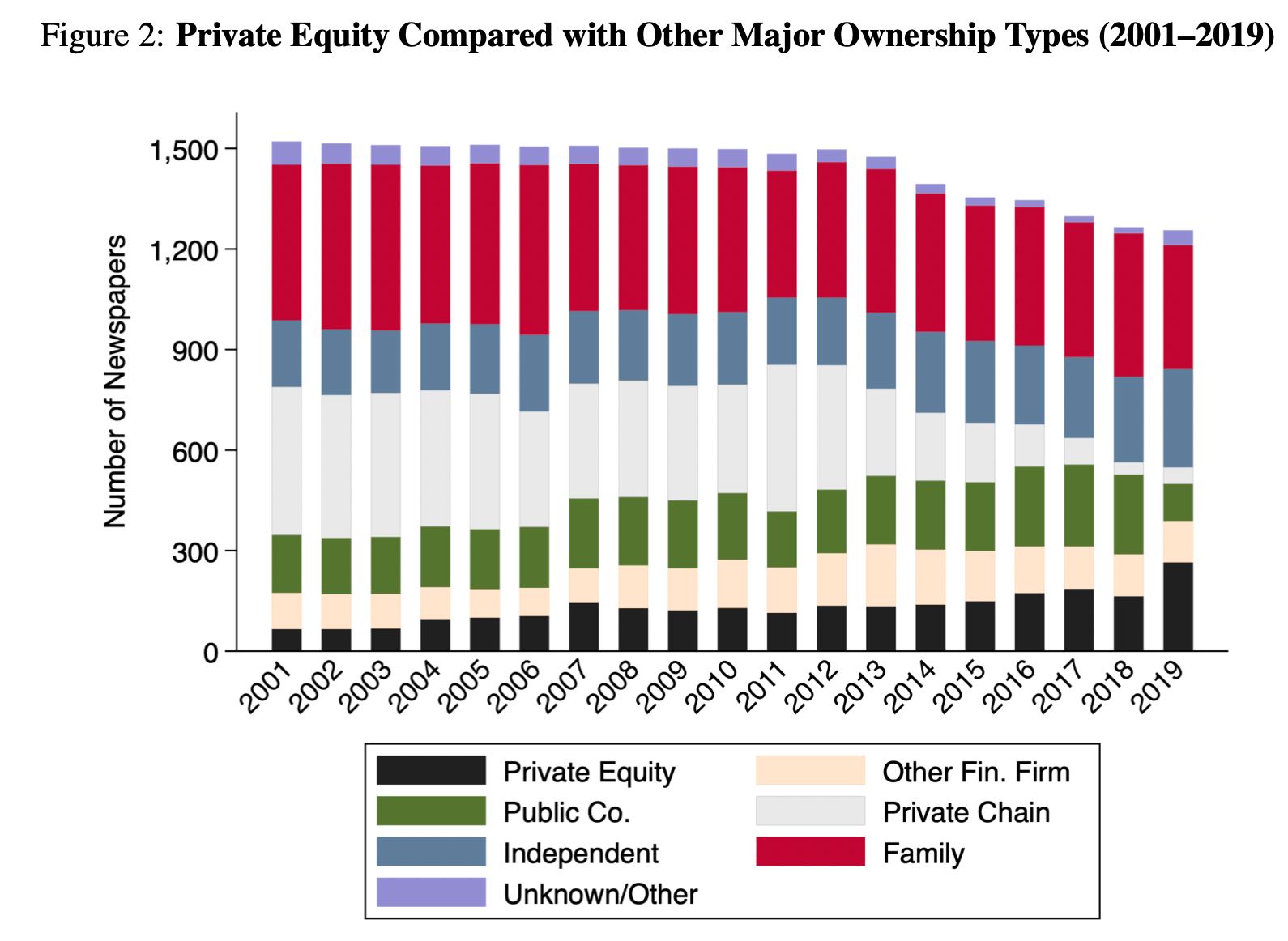

FEB 2024, R&R Review of Financial Studies

Local Journalism Under Private Equity Ownership

With: Arpit Gupta and Sabrina Howell (NYU Stern)

- Local daily newspapers play a critical role keeping the local population informed

- These papers are increasingly likely to have private equity (PE) owners

- We document nuanced impacts of PE ownership: lower closer rates, higher digital subscription, lower employment, less local news coverage and lower political participation

- Findings: PE investors help newspapers is a evolving industry adapt to digital technology, but at the cost of local information and in turn, political participation

Publications

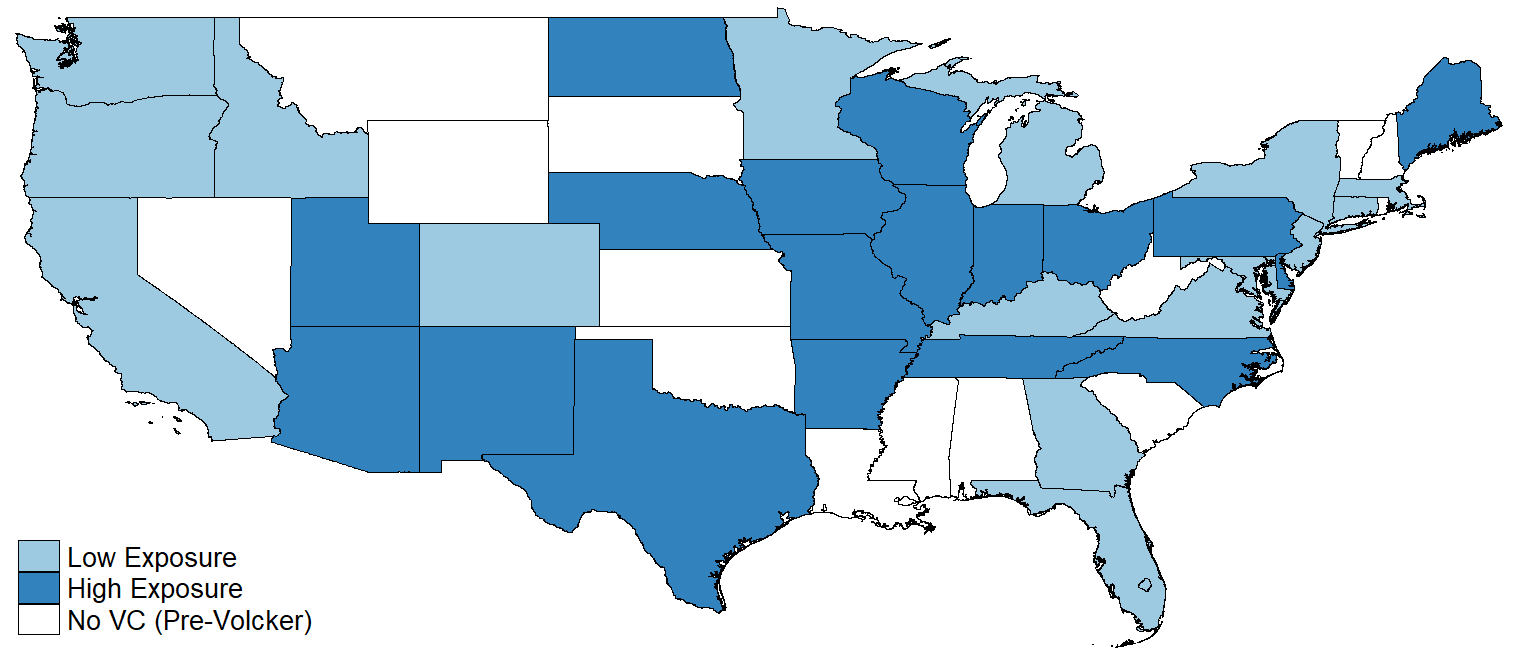

Aug. 2025, Journal of Finance

Venture Capital and Startup Agglomeration

With: Jun Chen (Univ. of IL, Chicago)

- Startup financing constraints can be partially explained by venture capitalist constraints

- Volcker Rule restricted the set of limited partners that could invest in VC

- This change had different impacts by states in the U.S.

- Findings: VC funds shrink, fundraising probabilities fall, startups absorb these VC financing constraints.

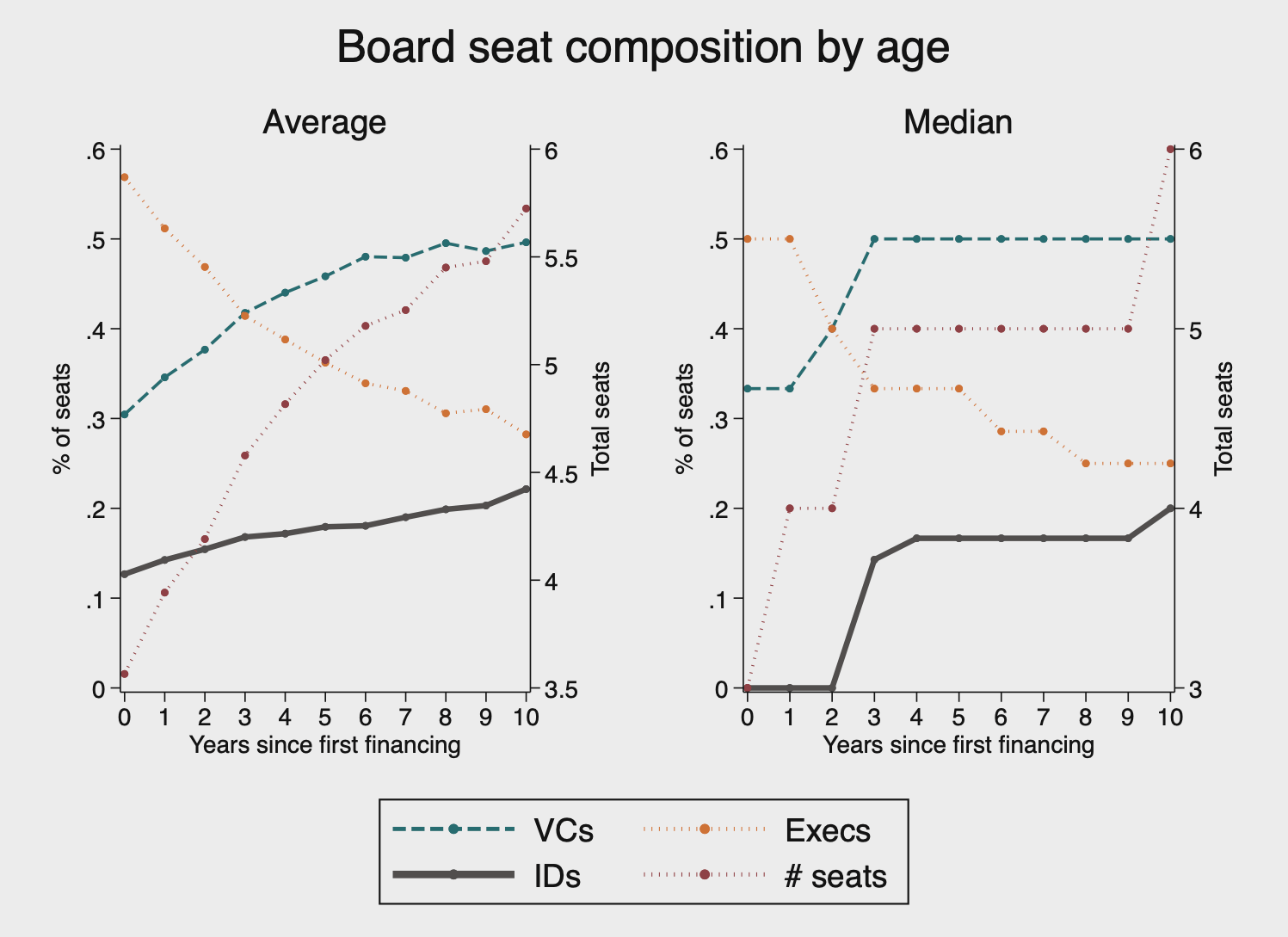

July 2024, Journal of Finance

Board Dynamics over the Startup Life Cycle

With:

Nadya Malenko (Boston College)

- The board of directors of VC-backed startups exhibits significant changes in control over time

- Control starts with the entrepreneur, shifts to a balance or “shared” and ultimately rests with VCs.

- The independent director facilitates the shared control board

- Independent directors help mediate conflicts between entrepreneur and VC

Sept 2023, Management Science

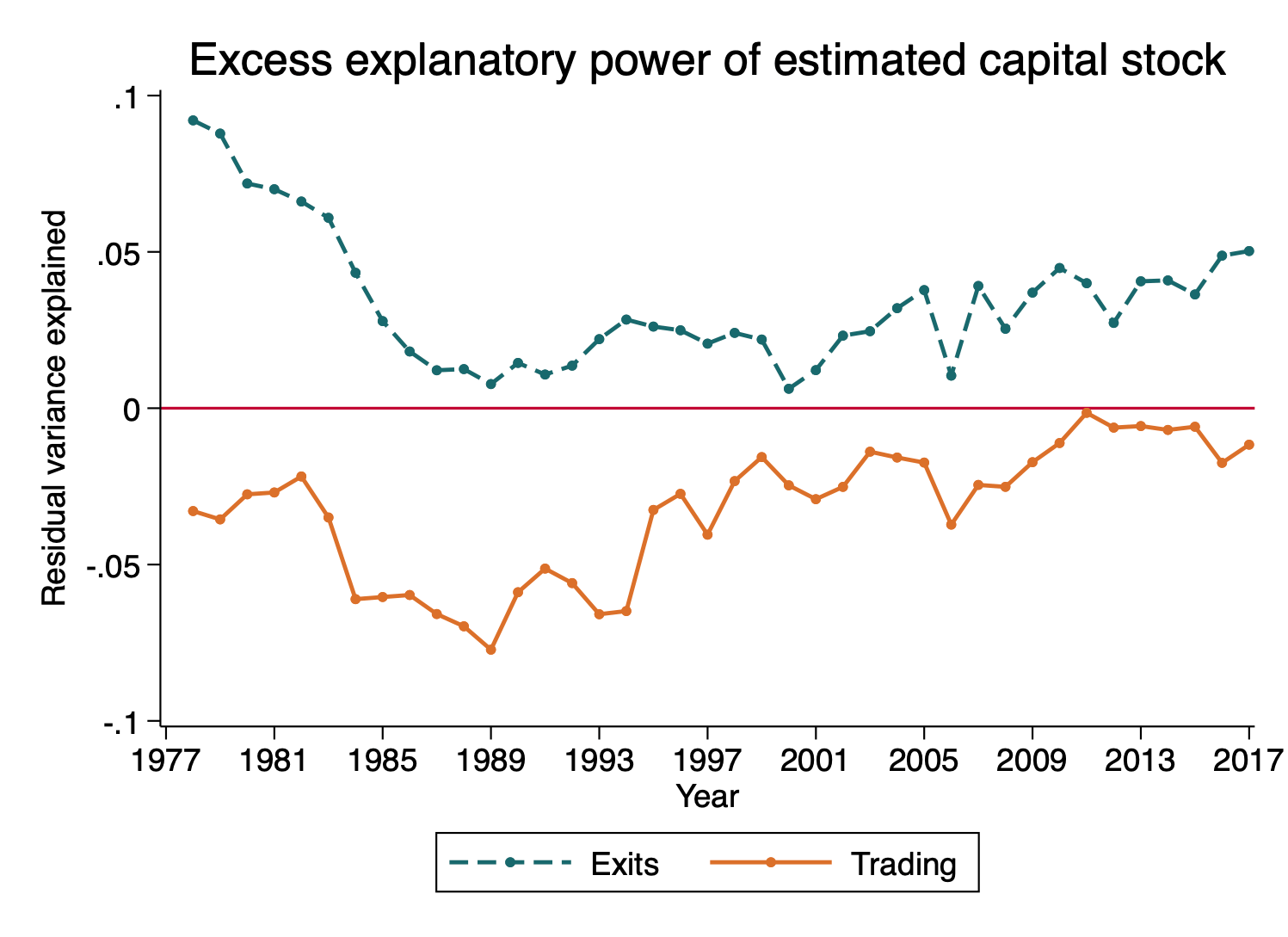

Measuring Intangible Capital with Market Prices

With:

Ryan Peters (Tulane) and Sean Wang (SMU)

- The capitalization of intangible investments – R&D and SG&A require depreciation parameters

- Market prices of intangible assets found via acquisition or trading of public securities provides information about these parameters

- Estimate knowledge (R&D) and organizational (SG&A) capital stocks with new parameter estimates

- Two stocks out-perform existing estimates in market value regressions, patents analysis and human capital regressions

November 2023, Journal of Financial Economics

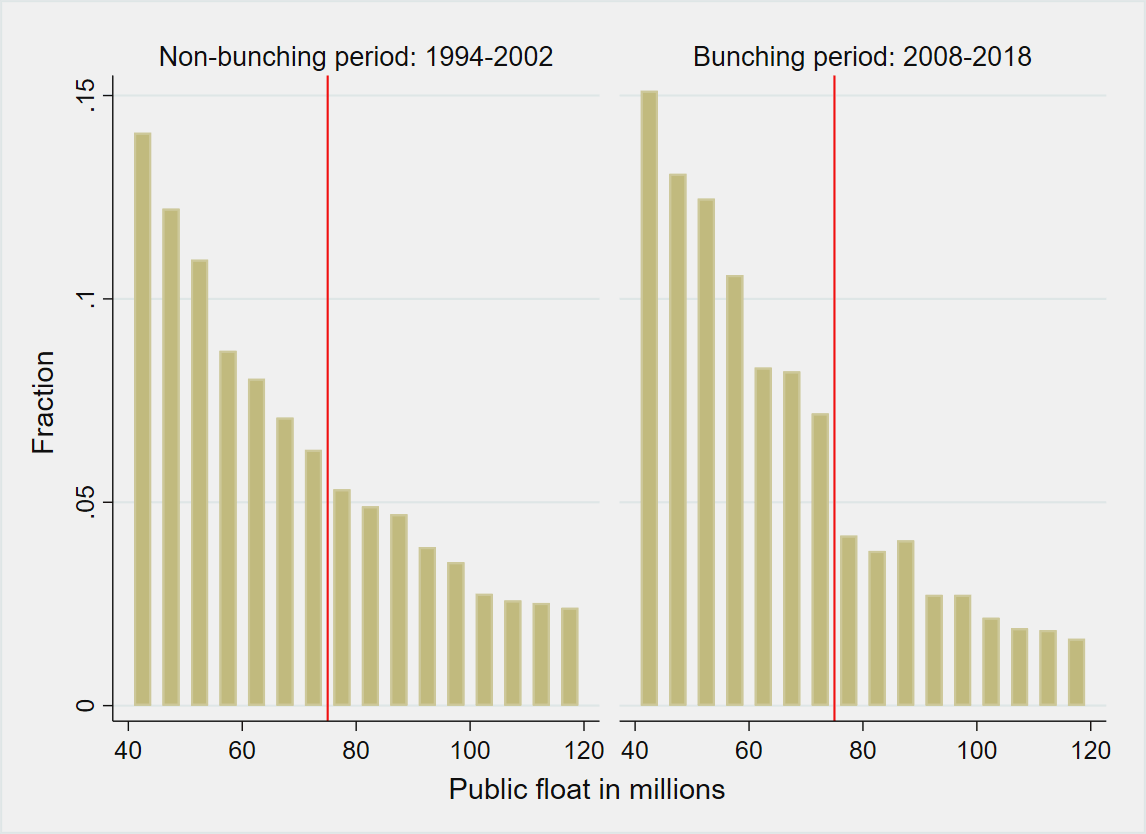

Regulatory Costs of Being Public: Evidence from Bunching Estimation

With:

Kairong Xiao (Columbia) and Ting Xu (Univ. of Toronto)

- Regulation a key part of the costs of being public and estimating the costs is challenging

- Study costs of disclosure and internal governance regulations

- Use bunching estimators to show that firms manipulate their public float to avoid certain regulations

- Develop a model to translate float distortion to firm value loss

- Findings: various disclosure and internal governance rules leads to a total compliance cost of 4.3% of the market capitalization for a median U.S. public firm.

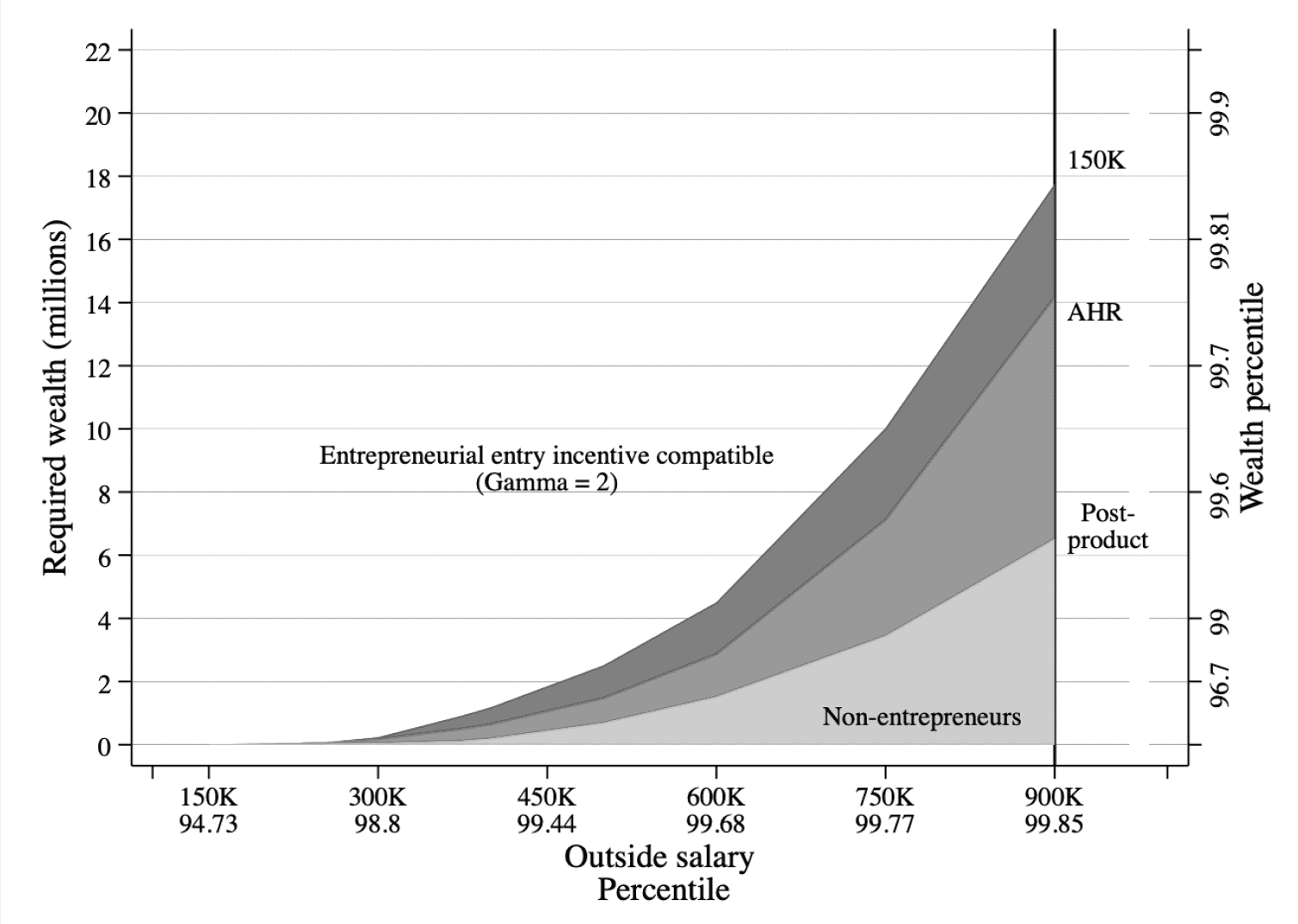

Aug. 2024, Journal of Finance

Founder-CEO Compensation and Selection into Venture Capital-Backed Entrepreneurship

With:

Ramana Nanda (Imperial) and Christopher Stanton (HBS)

- founder-CEOs of VC-backed startups have low pay for only a while

- a tangible product (“product-market fit”) dramatically increases liquid cash compensation

- “Product market fit” also coincides with key human capital in the startup becoming more replaceable.

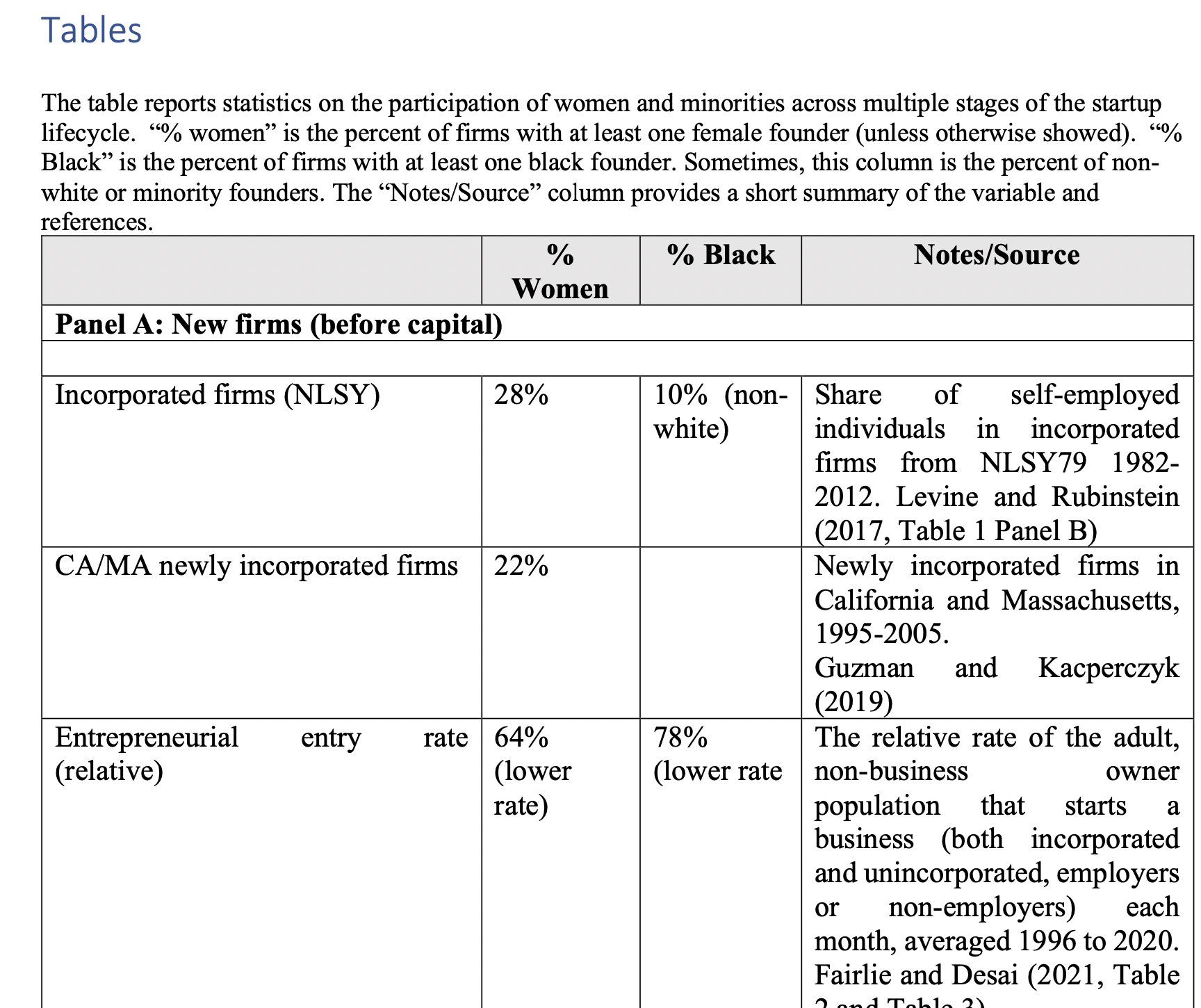

February 2023, Handbook of the Economics of Corporate Finance

Race and Gender in Entrepreneurial Finance

- A literature review of research on race and gender discrimination in venture capital, private equity and startups

- Overview of the economics of discrimination for empirical researchers

- Extensive summary of the main facts that connect race+gender to the founding, financing and success of startups

- Findings: Consistent evidence for differential treatment of women and minorities; large gaps in our knowledge about racial discrimination

Fall 2022, Annual Review of Financial Economics

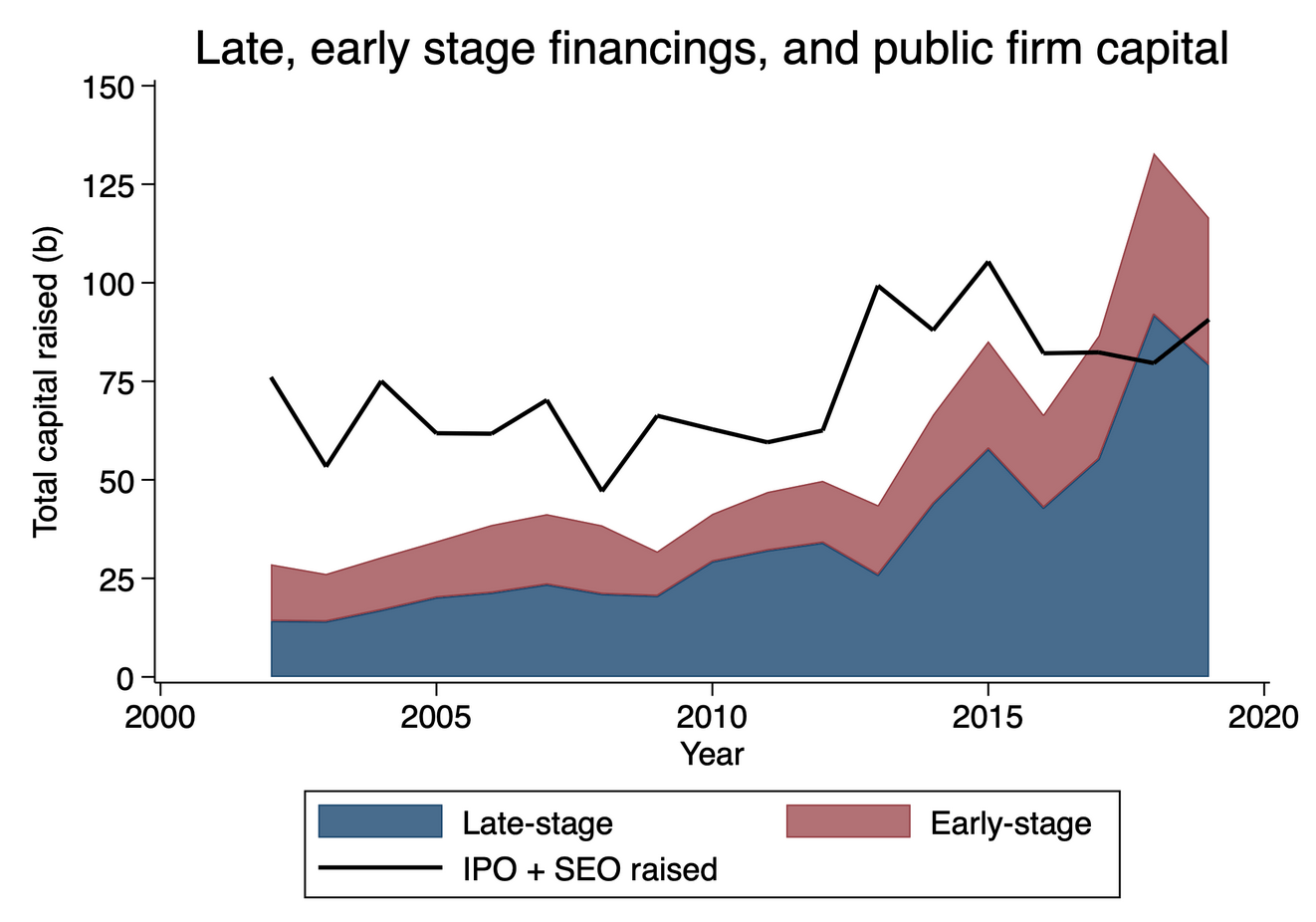

Private or public equity? The evolving entrepreneurial finance landscape

With: Joan Farre-Mensa (Univ. of IL, Chicago)

- A review of the differences between the public and private capital markets

- The growth in the private capital markets can be explained by a host of technological and financing changes

- Findings: Understanding changes in the public capital markets requires understanding how private capital markets develop

March 2021, Forthcoming Journal of Financial Economics

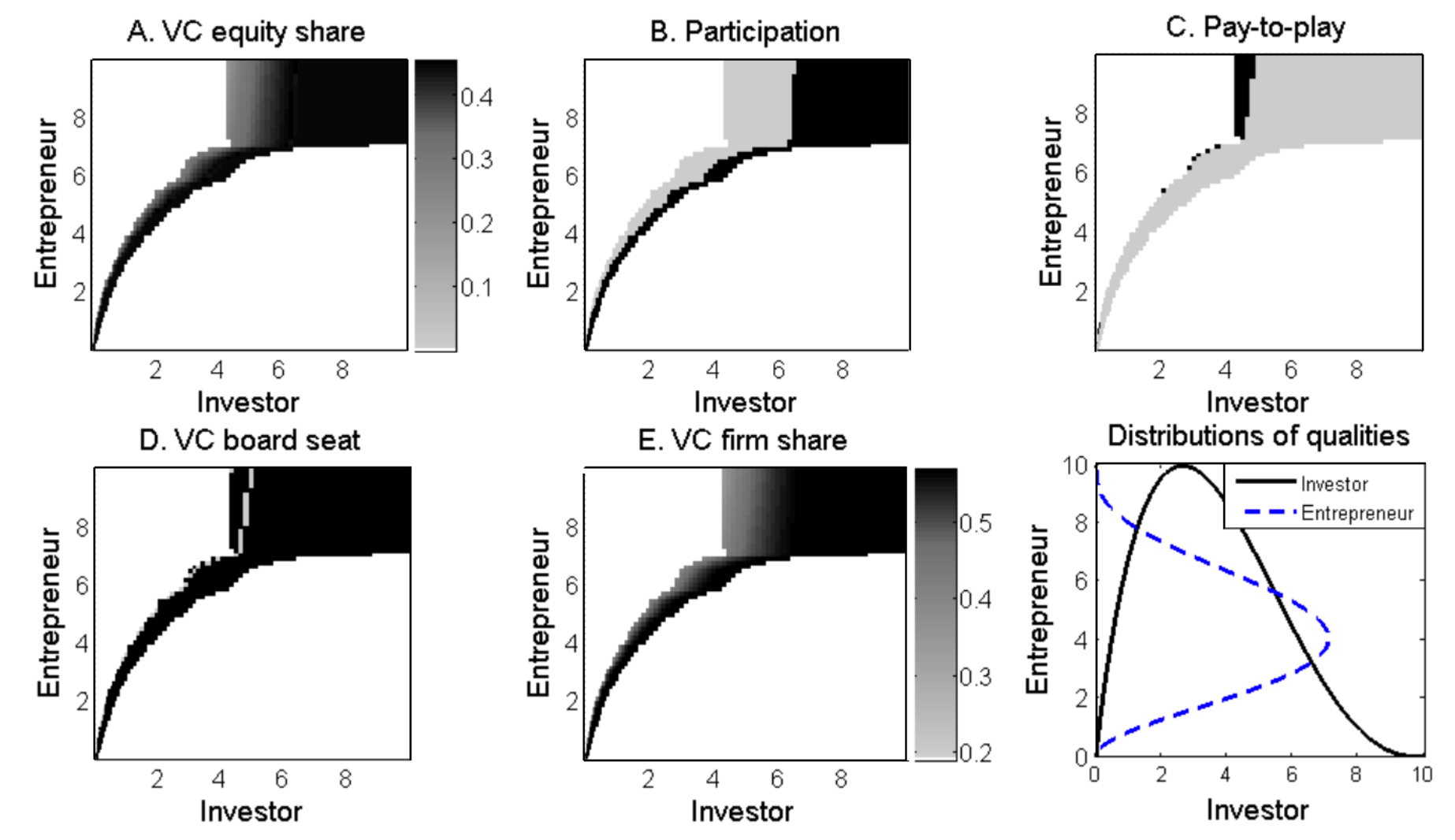

Venture Capital Contracts

With:

Alexander Gorbenko (UCL) and Arthur Korteweg (USC)

- The role of contracts in venture capital (VC) value creation and matching with entrepreneurs is unknown

- estimate the impact of contract terms on startup outcomes and the split of value between the entrepreneur and investor

- Findings: Venture capital contracts shift value from entrepreneur to VC. Any analysis of contracting must incorporate the complex matching between VC and entrepreneur.

2020, Review of Financial Studies (Editor’s Choice)

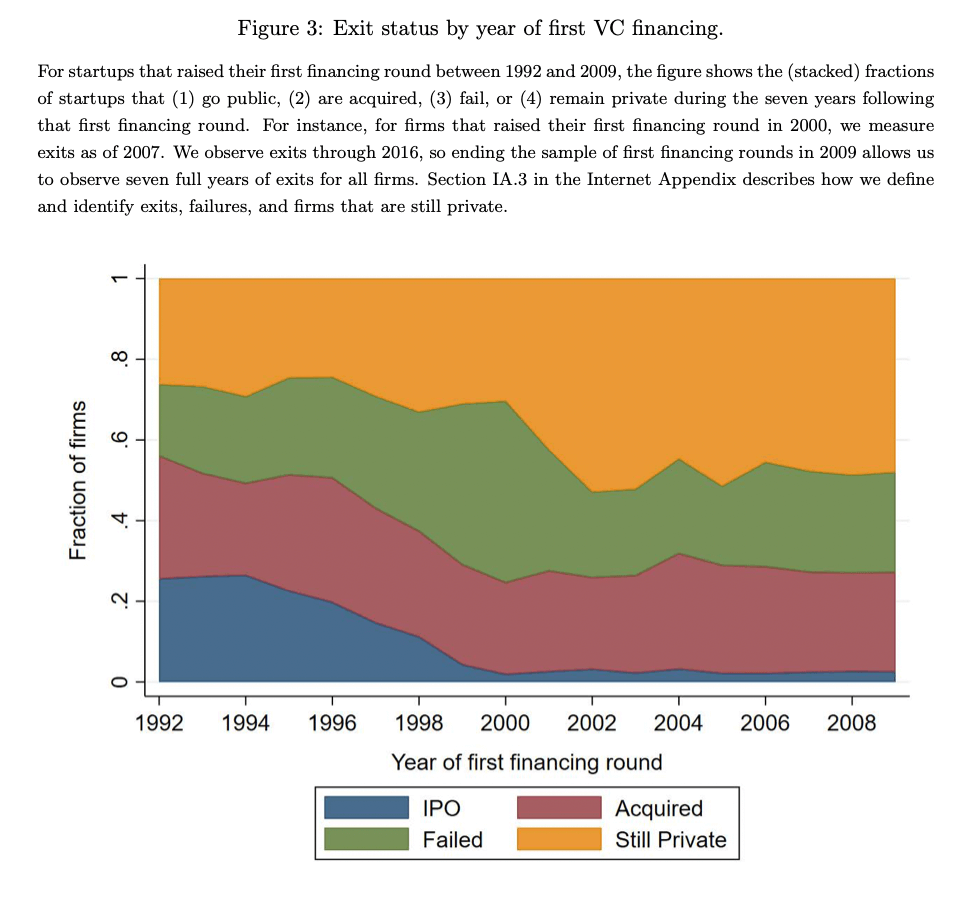

The Deregulation of the Private Equity Markets and the Decline in IPOs

With:

Joan Farre-Mensa (Univ. of IL Chicago)

The deregulation of securities laws|in particular the National Securities Markets Improvement Act (NSMIA) of 1996|has increased the supply of private capital to late-stage private startups, which are now able to grow to a size that few private firms used to reach. NSMIA is one of a number of factors that have changed the going-public versus staying-private trade-off, helping bring about a new equilibrium where fewer startups go public, and those that do are older. This new equilibrium does not reflect an IPO market failure. Rather, founders are using their increased bargaining power vis-a-vis investors to stay private longer.

2020, Journal of Financial Economics

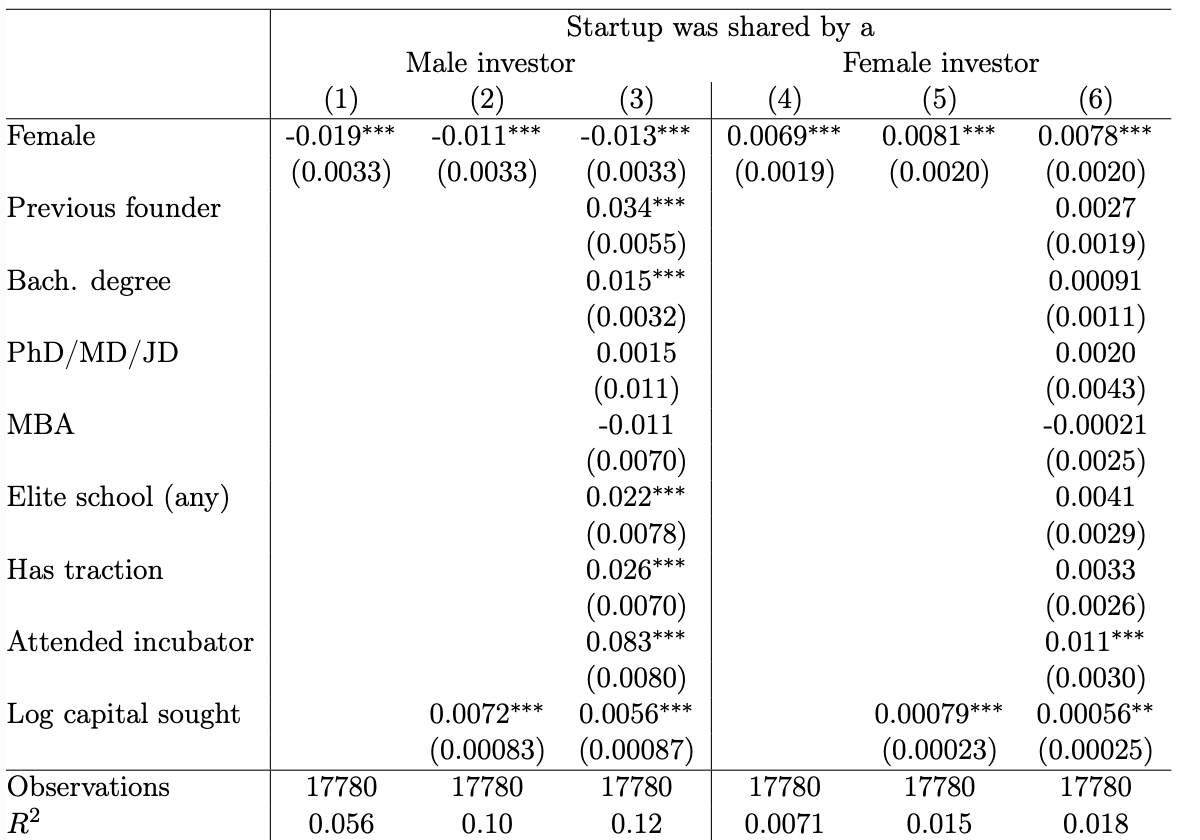

Are Early Stage Investors Biased Against Women?

With: Richard R. Townsend (UCSD)We study whether early stage investors have gender biases using a proprietary dataset from An- gelList that allows us to observe private interactions between investors and fundraising startups. We find that male investors express less interest in female entrepreneurs compared to observably similar male entrepreneurs. In contrast, female investors express more interest in female entrepreneurs. These findings do not appear to be driven by within-gender screening/monitoring advantages or gender differences in risk preferences. Moreover, the male-led startups that male investors express interest in do not outperform the female-led startups they express interest in—they underperform. Overall, the evidence is consistent with gender biases.

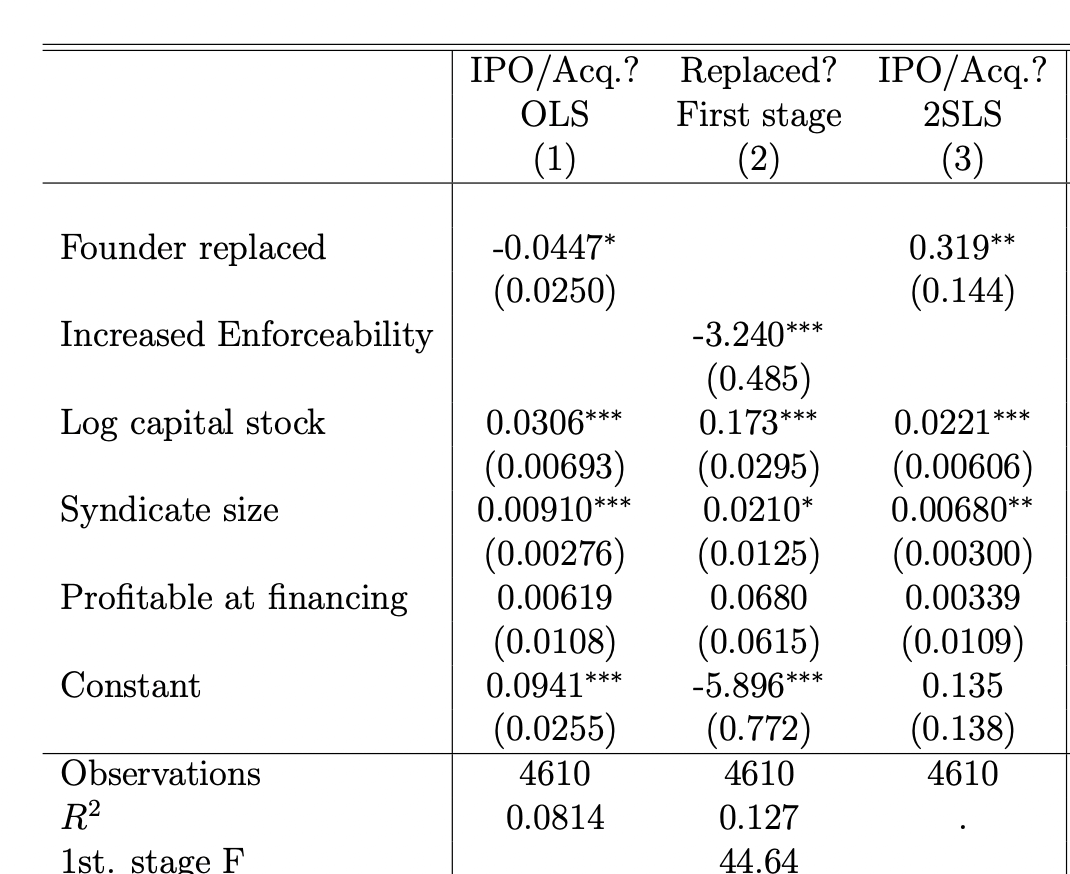

2018, Review of Financial Studies

Founder Replacement and Startup Performance

With: Matt Marx (Cornell)We provide causal evidence that venture capitalists (VCs) improve the performance of their portfolio companies by replacing founders. Using a database of venture capital financings augmented with hand-collected founder turnover events, we exploit shocks to the supply of outside executives via 14 states’ changes to non-compete laws from 1995 to 2016. Naive regressions of startup performance on replacement suggest a negative correlation that may reflect negative selection. Indeed, instrumented regressions reverse the sign of this effect, suggesting that founder replacement instead improves performance. The evidence points to the replacement of founders as a specific mechanism by which VCs add value.

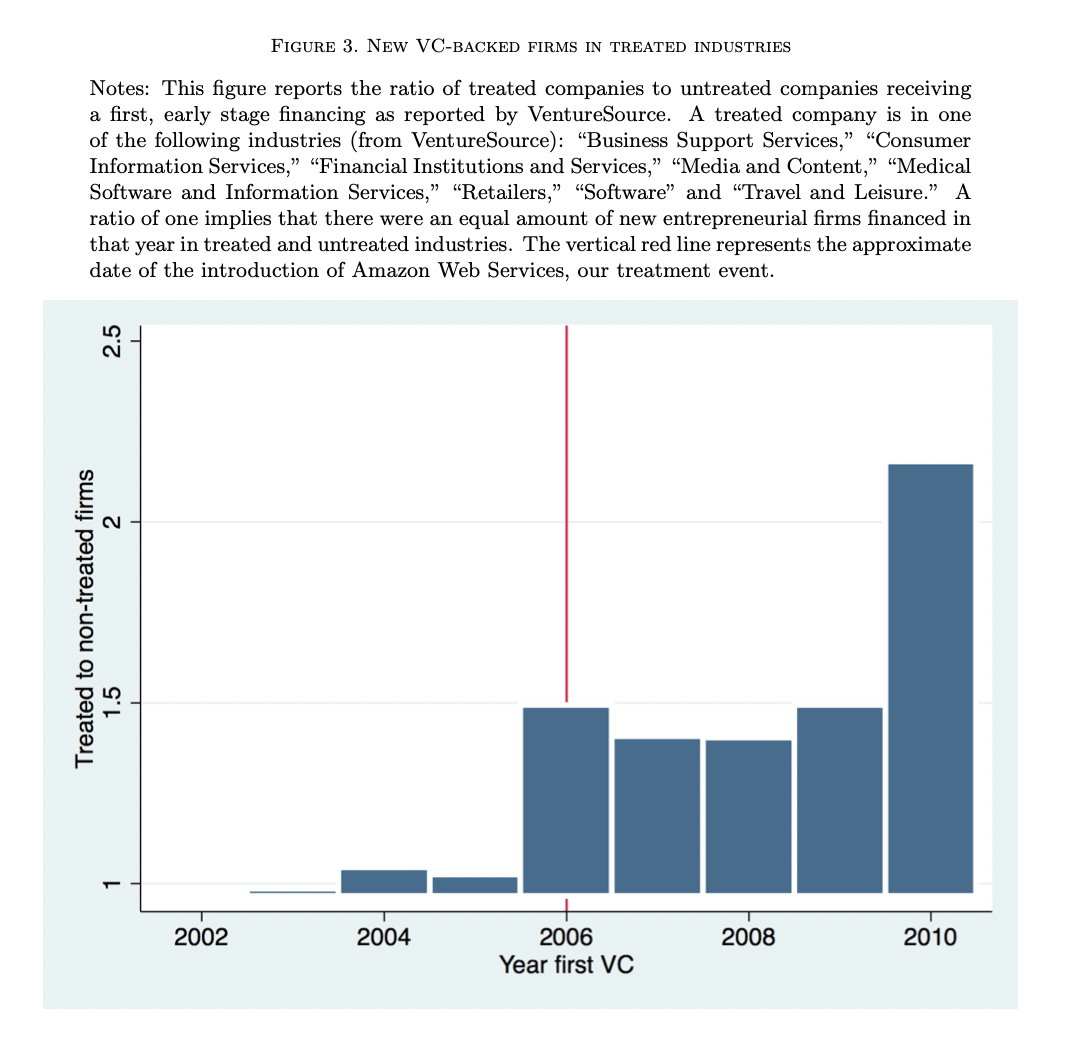

2017, Journal of Financial Economics

Cost of Experimentation and the Evolution of Venture Capital

With: Ramana Nanda (Imperial) and Matthew Rhodes-Kropf (MIT)We study how technological shocks to the cost of starting new businesses have led the venture capital model to adapt in fundamental ways over the prior decade. We both document and provide a framework to understand the changes in the investment strategy of venture capitalists (VCs) in recent years – an increased prevalence of a “spray and pray” investment approach – where investors provide a little funding and limited governance to an increased number of startups that they are more likely to abandon, but where initial experiments significantly inform beliefs about the future potential of the venture. This adaptation and related entry by new financial intermediaries has led to a disproportionate rise in innovations where information on future prospects is revealed quickly and cheaply, and reduced the relative share of innovation in complex technologies where initial experiments cost more and reveal less.

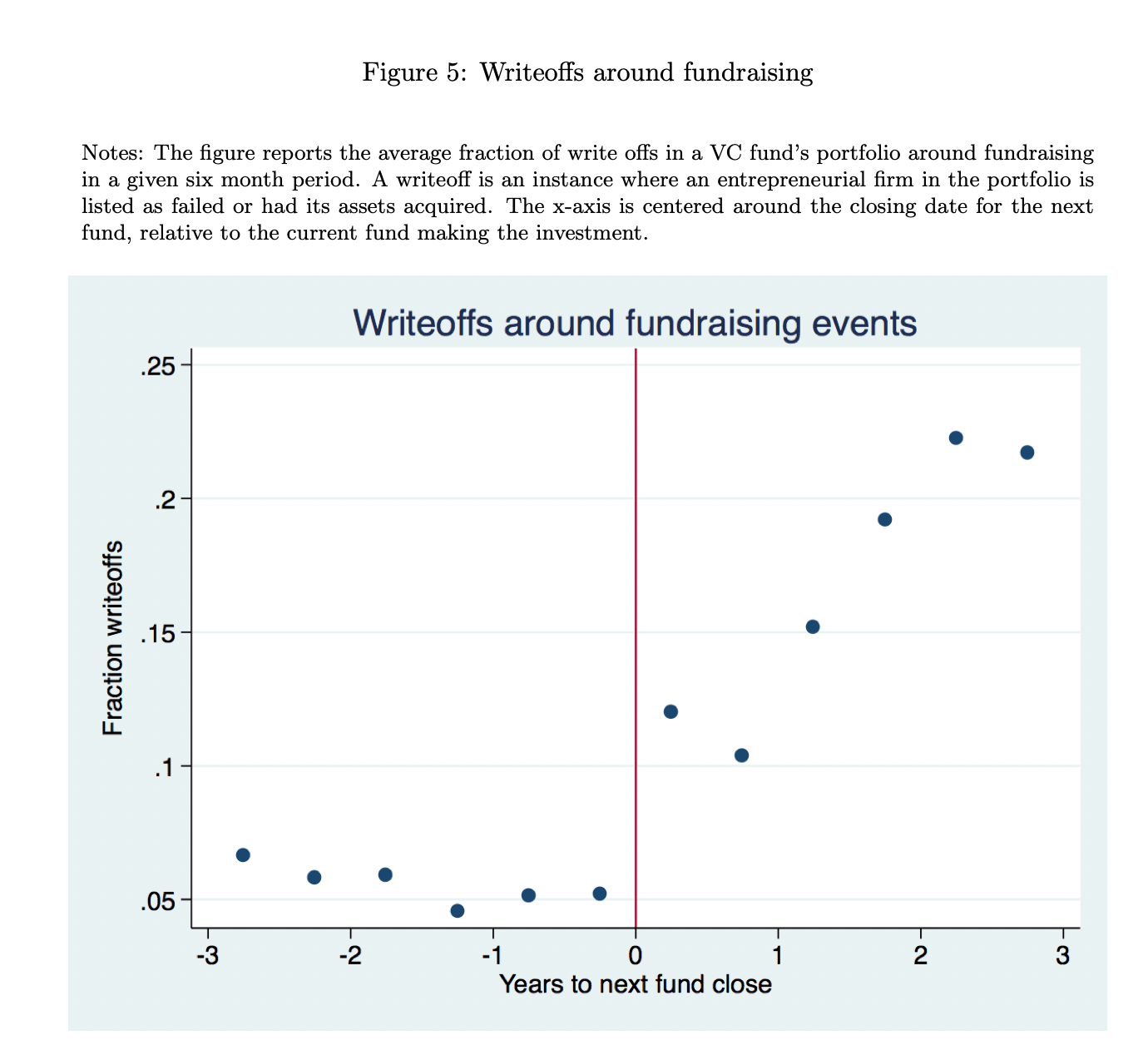

2017, Management Science

Managing Performance Signals Through Delay: Evidence from Venture Capital

With:

Indraneel Chakraborty (Univ. of Miami)

- The role of contracts in venture capital (VC) value creation and matching with entrepreneurs is unknown

- estimate the impact of contract terms on startup outcomes and the split of value between the entrepreneur and investor

- Findings: Venture capital contracts shift value from entrepreneur to VC. Any analysis of contracting must incorporate the complex matching between VC and entrepreneur.

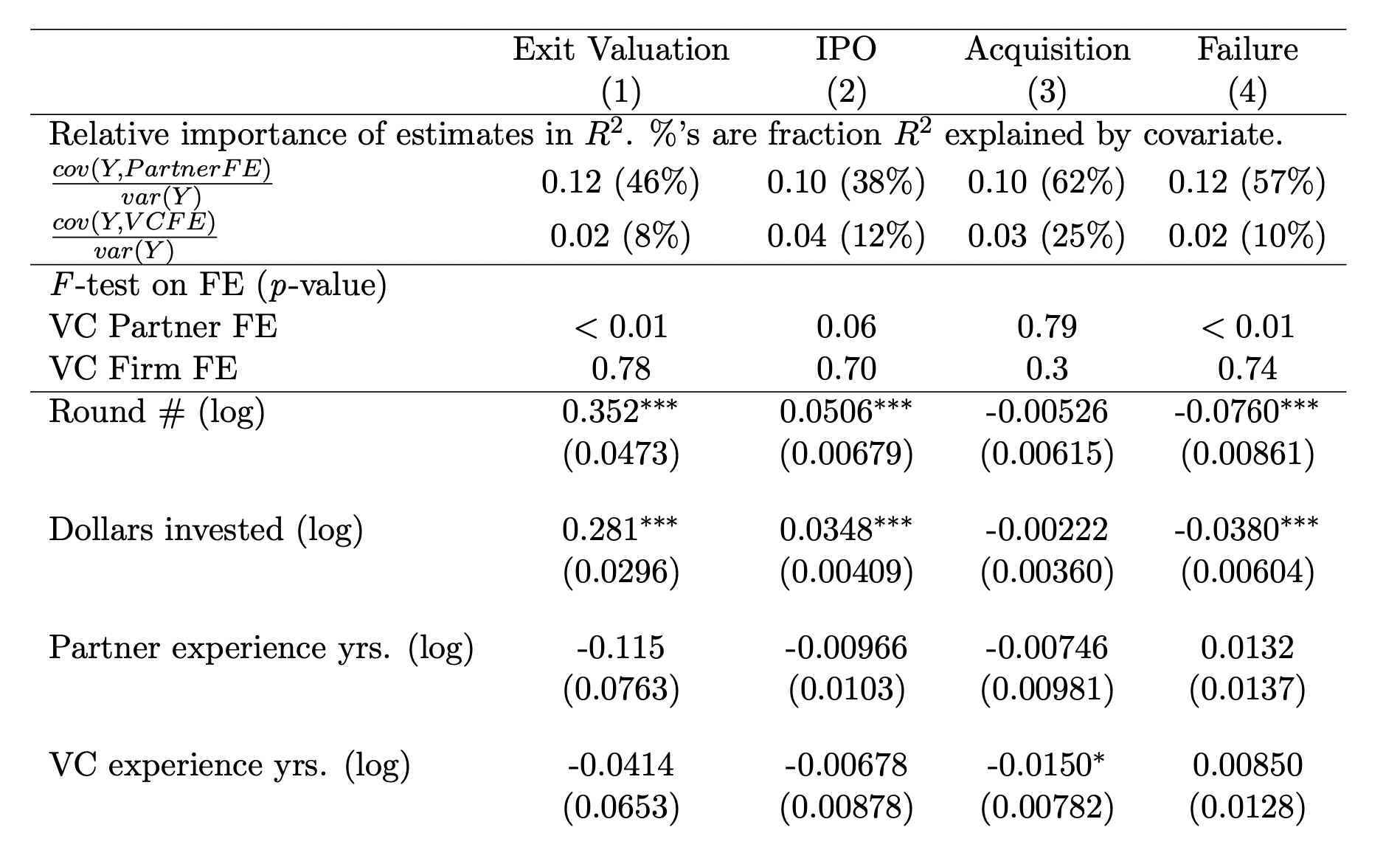

2015, Journal of Finance

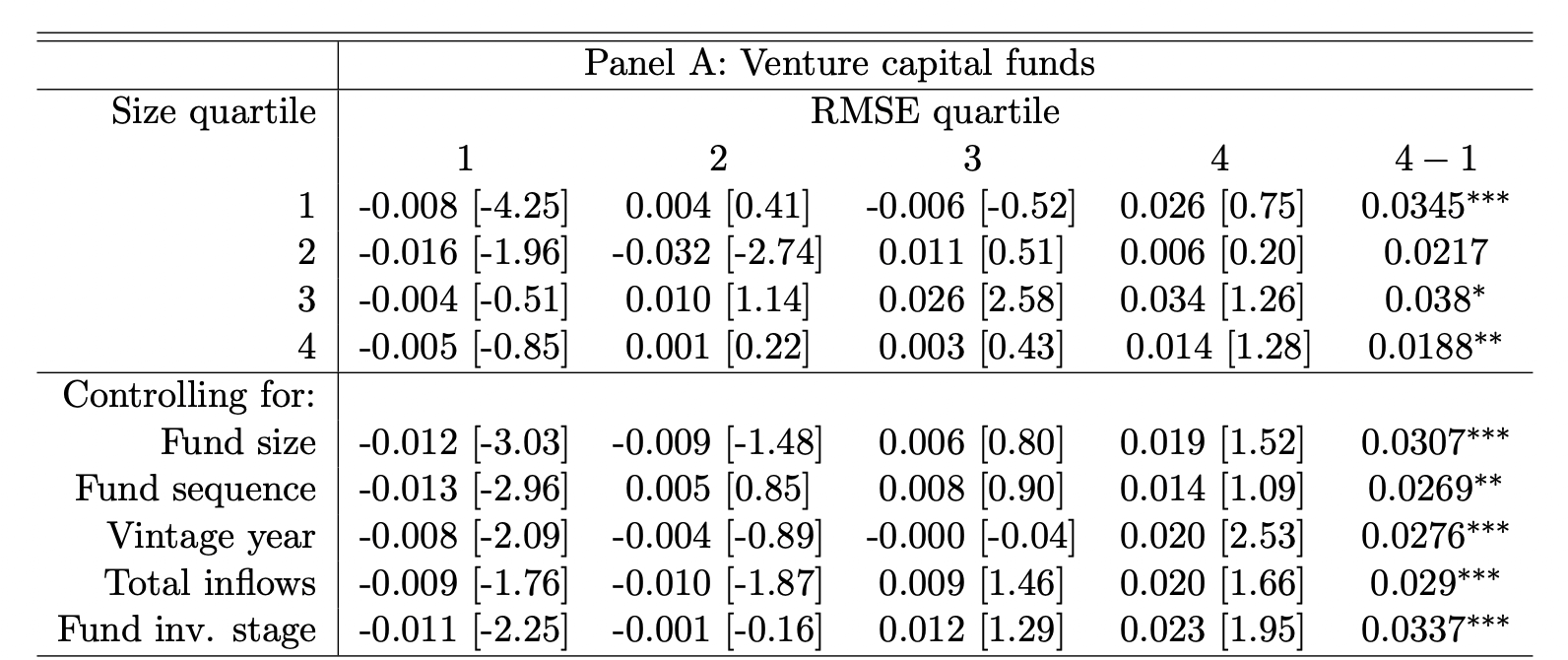

Is the VC Partnership Greater than the Sum of its Partners?

With: Matthew Rhodes-Kropf (MIT)This paper investigates whether individual venture capitalists have repeatable investment skill and the extent to which their skill is impacted by the venture capital (VC) firm where they work. We examine a unique data set that tracks the performance of individual venture capitalists’ investments over time and as they move between firms. We find evidence of skill and exit style differences even among venture partners investing at the same VC firm at the same time. Furthermore, our estimates suggest the partners’ human capital is two to five times more important than the VC firm’s organizational capital in explaining performance.

2014, Review of Economics and Statistics

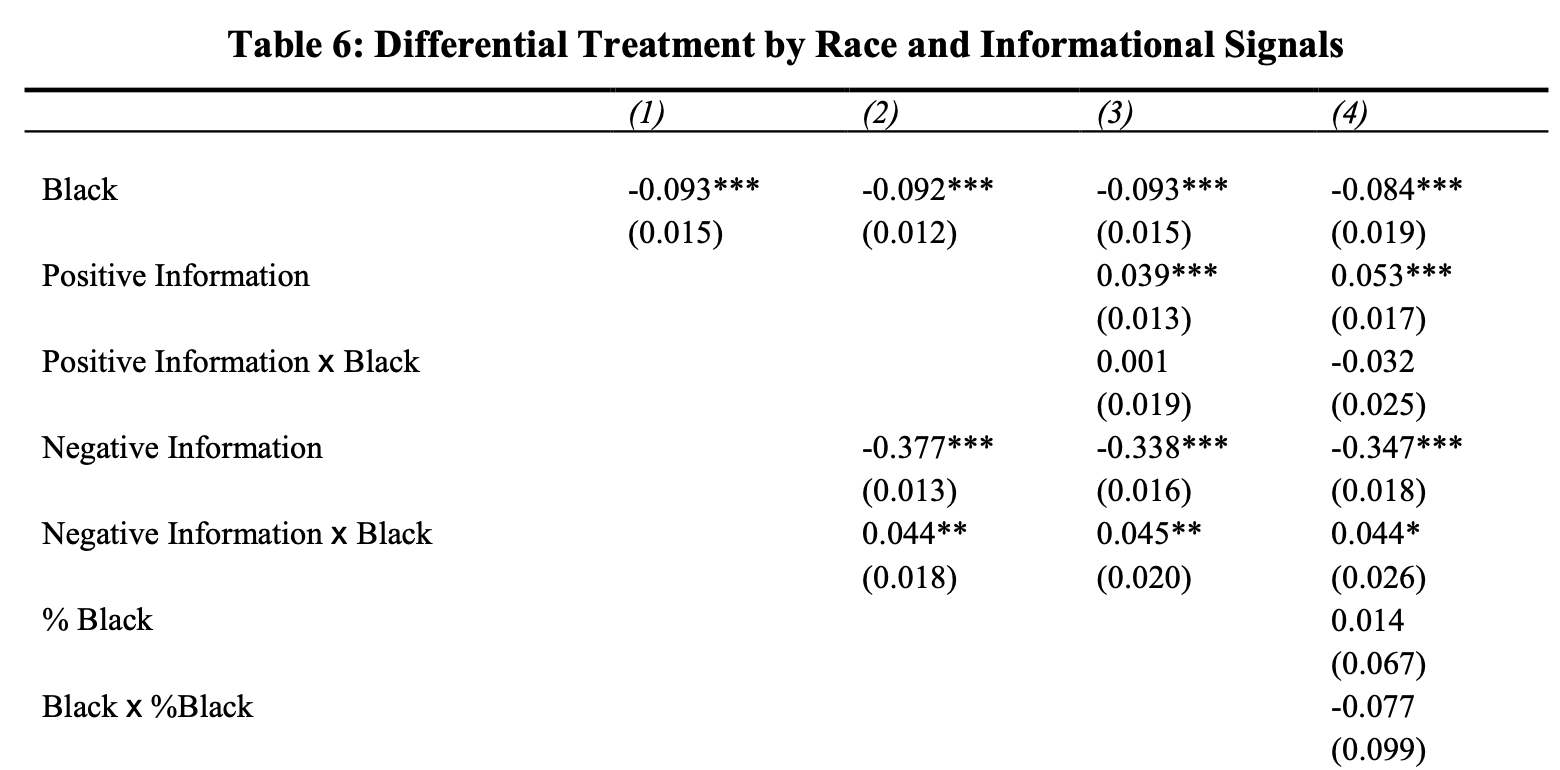

Statistical Discrimination or Prejudice? A Large Sample Field Experiment

With: Bryan Tomlin (Cal. State CI) and Liang Wang (Monash)A model of racial discrimination provides testable implications for two features of statistical discriminators: differential treatment of signals by race and heterogeneous experience that shapes perception. We construct an experiment in the U.S. rental apartment market that distinguishes statistical discrimination from taste-based discrimination. Responses from over 14,000 rental inquiries with varying applicant quality show that landlords treat identical information from applicants with African-American and white sounding names differently. This differential treatment varies by neighborhood racial composition and signal type in a manner consistent with statistical discrimination and in contrast to patterns predicted by a model of taste-based discrimination.

2013, Review of Financial Studies

The Price of Diversifiable Risk in Venture Capital and Private Equity

With:

Charles Jones (Columbia) and Matthew Rhodes-Kropf (MIT)

This paper demonstrates how the principal-agent problem between venture capitalists and their investors (limited partners) causes limited partner returns to depend on diversifiable risk. Our theory shows why the need for investors to motivate VCs alters the negotiations between VCs and entrepreneurs and changes how new firms are priced. The three-way interaction rationalizes the use of high discount rates by VCs and predicts a correlation between total risk and net of fee investor returns. We take our theory to a unique data set and find empirical support for the effect of the principal-agent problem on equilibrium private equity asset prices.