Identification Problem

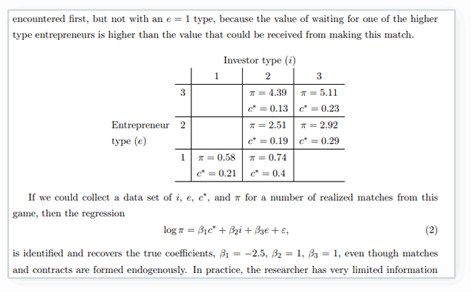

To illustrate the identification problem and the source of variation the model exploits, consider the following example. Entrepreneurs search for an investor to finance their startup company, while at the same time investors are searching for entrepreneurs to fund. Due to search frictions, potential counterparties encounter each other randomly (an assumption we relax in an extension). Upon meeting, the parties attempt to negotiate a contract that is acceptable to both sides. For the purpose of this example, a contract, c, is the share of common equity in the startup received by the investor.

π = i · e · exp{−2.5 · c}. (1) The negative impact of c on the value can be justified by entrepreneurs working less if they retain a smaller share of the startup (in the estimation, we do not restrict the impact to be negative).

Data

We construct the initial sample from several sources, starting with financing rounds of U.S.- headquartered startup companies between 2002 and 2015, collected from the Dow Jones VentureSource database. We augment this sample with data from Venture Economics (a well-known venture capital data source), Pitchbook (owned by Morningstar), and Correlation Ventures (a quantitative venture capital fund). These additional data significantly supplement and improve the quality and coverage of financing round and outcome information, such as equity stakes, acquisition prices, and failure dates.

Results

Regression Analysis

The results reveal a U-shaped relationship between VC equity share and outcomes. This result is counterintuitive as it suggests that full ownership by either a VC or entrepreneur maximizes the probability of success.

Search Model

The simple regressions of the previous section do not control for the selection issues and omitted variables described in the identification section above. We address these problems using the search model. To operationalize the model, we have to make a few implementation choices.